Since Christopher talked last week about being his own production studio, I thought it would be important to go step by step through how to start a production company.

Since Christopher talked last week about being his own production studio, I thought it would be important to go step by step through how to start a production company.

Before we dive in, I want to tell you that I am not a lawyer or a CPA. We’ve learned this information over the years from setting up our own companies. You should consult the right people before jumping into anything.

If you are itching to get your production company up and running a great legal guidebook for filmmakers is The Independent Film Producer’s Survival Guide, where entertainment lawyers walk through the legality of setting up your production.

I’ll be referencing LegalZoom frequently in this post, linking to specific pages so you file your business quickly. Full disclosure as usual, these are affiliate links, but are incredibly helpful to get you started.

Some of this stuff can be a little dense, and it can be a lot to take in at once. If you’re reading this for the first time, don’t get too discouraged — it took me a long time to process everything. 🙂

WHY ARE WE STARTING A PRODUCTION COMPANY?

Christopher and I have always had the mindset of creative entrepreneurs — we started hanging out in the 5th grade because we wanted to start making movies and I owned a camera. From there it’s been a natural progression. We formed our first company as sophomores in high school because we started picking up freelance gigs getting paid to shoot for local businesses.

My only regret is that we didn’t start our first company earlier.

Since high school we kept our company going, but also went on to do other stuff on our own. ShoHawk is the culmination of all those past projects and experiences. The biggest reason to start a company when doing freelance work is to keep your personal assets safe in case you get sued. You’ll also get certain tax advantages where you can write off certain expenses.

TYPES OF BUSINESSES

There are a few types of businesses and it’s important to know the difference when you’re starting. There are varying tax structures for each of these, and the start up costs differ for each. Here’s a brief overview of each, but if you really want a breakdown of the details you can read up more on the IRS website.

SOLE PROPRIETOR

When I worked in accounting, a lot of the crew were independent contractors, or paid as a sole proprietor. Sole proprietorship is the easiest business to set up, but there are a few drawbacks — the biggest being that there is no legal distinction between you and your business. While you will reap all the profit, you will be personally liable for anything that happens.

It’s also hard to take a loan as a sole proprietor since you’re dealing only with your personal assets. If you wanted to start a production company and take a loan from the bank for equipment sole proprietorship probably isn’t for you. The best part of being a sole proprietor is that no paperwork needs to be filed with your state.

If you want to become a sole proprietor with a business name, you will need to file a DBA, “Doing Business As”, and obtain a local business license.

Pros:

• You get all the profit

• Easy to setup – don’t need to do any paperwork with the state

• Easy taxes – goes through your personal return

Cons:

• Unlimited personal liability

• YOU are solely responsible for the business

• Tough to get loans

GENERAL PARTNERSHIP

This is what Christopher and I started with in high school — it was great for us at the time since we didn’t have many personal assets to worry about. It’s a similar setup to sole proprietorship, just with more than one person. A General Partnership can be a little scary because you will be liable for any mistakes your partners make.

There is a little more paperwork with a partnership, but you still don’t need to register with the state. For a general partnership you should set up a DBA name and set up a business checking account. Your tax return will still be filed with your personal tax return.

Pros:

• Easy to form

• Easier to raise money than sole proprietorship

• Easy tax return — file through personal tax return

Cons:

• Your personal assets are at stake, even if your partner that screws up

• Partnerships can be unstable

• All decisions need unanimous consent

CORPORATION

The biggest advantage of having a corporation is the fact that it is taxed as a completely separate entity from yourself and your partners. If you were to die, the business would not die with you. If the corporation were sued, you as the business owner would not need to worry about your personal assets. It’s taxed completely separately from your personal tax return, which can get a little hairy around tax time if you’re not on top of your finances.

In the past I’ve set up an S-Corporation for some side projects, but it’s really overkill for what Christopher and I will be doing. Corporations are pretty tedious to set up, and if you’re not looking at getting any shareholders involved in your business, it’s probably not worth your time.

C Corp Pros:

• Easier to get a loan

• You can have shareholders, which can help fund the company quickly

• Completely separate entity from the owners

C Corp Cons:

• Profits will be taxed twice because it’s a separate entity from you and the shareholders

• If you have shareholders, they can control the decisions of the company

• Not easy to set up

S Corp Pros:

• No double taxation

• Shareholder + owners are not personally liable (you can lose your investment in the company, but no personal assets)

• Easy to get loans

S Corp Cons:

• Not easy to set up

• File a separate tax return

LLC

LLC stands for Limited Liability Company, which gives you a more flexible tax structure, while having restricted liability like a corporation. An LLC is really the best of both worlds for a small business because. Getting started with an LLC isn’t too expensive or time consuming, so it’s the approach we’ll be taking with ShoHawk.

We’re both fairly comfortable working with an LLC, Christopher set on up for his company on the film LIGHT, and a lot of the films I’ve done accounting on were set up as LLCs.

An LLC can be taxed like a Sole Proprietor, Partnership, S Corp, C Corp, which is nice that you have the ability to choose what’s best for your company.

Pros:

• The liability of the owners is limited to their investment in the company

• Corporations, individuals, and partnerships can all participate in an LLC

• There’s no limit on how many people can participate in an LLC

• No double taxation, you can file your taxes with your personal return

• Very flexible

Cons:

• LLCs are still fairly new and legality surrounding an LLC can sometimes be ambiguous

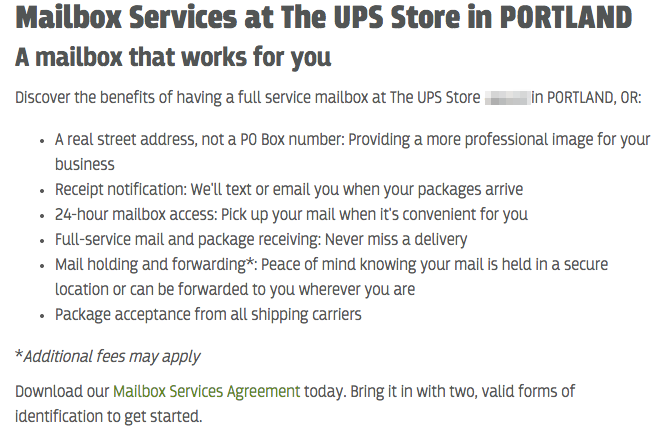

WHY YOU NEED A UPS BOX

When you form your company you need a physical address to register. Unfortunately, you can’t use a P.O. Box when registering for an LLC or a corporation. It’s dangerous to list your home address as the address on the registration because that becomes public record on your state’s database for registered businesses.

Since you’ll be working in the public eye, it’s best to keep your home address and business address separate. Eventually, you’ll want to set up an email list to keep your fans engaged with your work, and if you live in the U.S. you’ll also need a physical address to tie to your email list because of the CanSpam Act.

If you have the money, and want to rent office space, that’s is a completely viable option. Since Christopher and I are trying to keep our start up costs as low as possible, so we have more money for our projects. We’re opting to use a UPS mailbox.

Unlike P.O. Boxes, the UPS mailbox will actually give you a suite number you can use as a street address.

At our nearest UPS Store it cost us $120 to rent the smallest mailbox for a year, plus a $20 start up fee, and $5 key fee. So, in all $145 for a year isn’t so bad to get something that’s required for your business. Just think of all these startup costs as an investment. Really, you’re investing in your future, which is the best investment of your time and money.

You can find listings for your local UPS Store here. Each location costs differently to set up your mailbox, so call ahead and double check their rates. Once you find your location and want to set up a mailbox, fill this paperwork you can take to the nearest location.

If you have any questions this video covers the second half of the paperwork fairly thoroughly. Once you fill out your paperwork you’ll have to take two forms of ID with you — I took my driver’s license and my driver’s insurance card.

Here’s a list of all the advantages of having your own UPS box:

HOW TO GET A FREE PHONE NUMBER

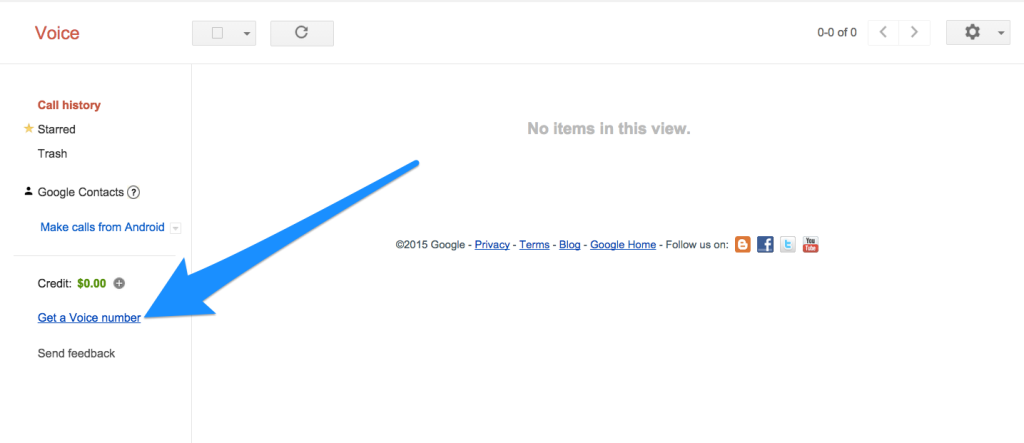

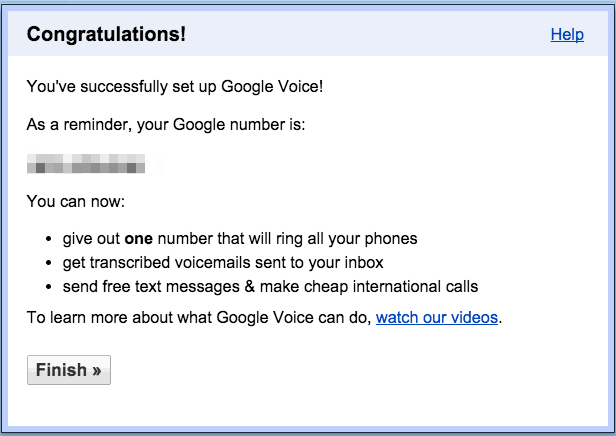

When you’re signing up for all the required business forms there will come a point when you need to enter your phone number. There are a couple things you can do. You can either use your cell phone number, and have that on file, OR you can register a brand new phone number for free using Google Voice.

Google Voice is awesome. It will give you a phone number that will re-route to your cell phone, but not using your personal cell phone number. You will be able to set up a voice mailbox for your production company on this phone line, so you can receive messages, for your production company and keep your personal cell phone line and your professional phone line separate.

You will need to have an active Gmail account to sign up for Google Voice and once you sign in, go to: https://www.google.com/voice, which will take you through a series of promts to set an additional phone number to your cell phone.

Click, “Get a Voice number” on the left side of your screen.

This gives you the option to either use your existing mobile number, or set up a brand new number.

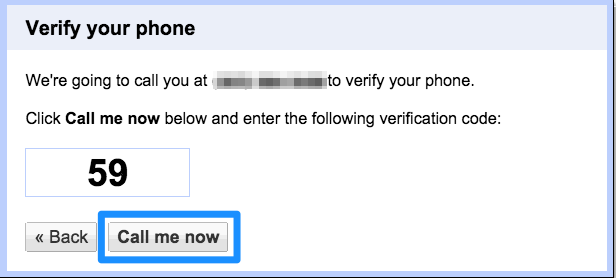

If you want a new number for your production company they will call you with a verification at your current cell phone number.

Once they call, all you have to do is enter the verification code on the keypad of your phone. Once your phone has been verified, your Google account will ask if want a brand new phone number, and you can search for local numbers:

Once you search numbers, you can pick the one you like best and set it to ring through to your phone.

Easy peasy.

CHOOSING YOUR COMPANY NAME

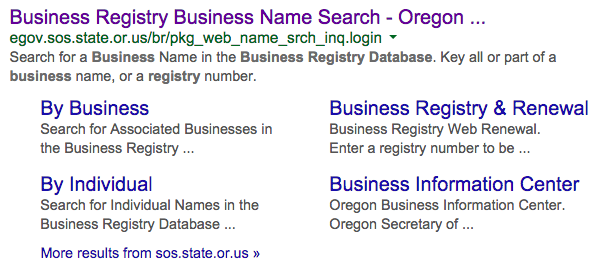

Once you’ve decided which business structure will work best for your production company you’ll be ready to choose a name for your company. First you’ll need to search your state’s registered business names to make sure the name you want isn’t already registered. To check, Google: your state’s name business registry database. The first result should be what you’re looking for.

For example, when I Google: Oregon business registry database, this is the first result.

Once I’m in the database I can search for any name to see if it’s registered. You can also search the national trademarks just to see if any results pop up at uspto.gov. There are three rules to follow when naming your business if you are using an LLC.

It’s a unique name, differing from other names registered in your state (you just checked this on the database).

Your company needs to end in the letters, “LLC”. For example, the full name of our company is ShoHawk Media, LLC.

The name of your company cannot use terms restricted by your state, like “trust”, “bank”, or “insurance”. Not that we wanted to, but we couldn’t call our company ShoHawk Trust, LLC, or ShoHawk Bank, LLC.

Here’s a little more information to consider when you’re choosing your production company’s name.

REGISTER YOUR BUSINESS

There are a couple ways to register your business with the state. One is through your state’s website, which varies in difficulty from state to state. The second is through LegalZoom.

If you’re unsure about the details of what exactly your state needs, LegalZoom might be the best option. It is a little more expensive than if you registered directly through your state’s website, but it holds your hand through the process, which helps peace of mind.

If you go the LegalZoom route, click through the link above which will take you to a “get started” page.

From here, there are five easy steps:

- Name & Address

- Owners & Management

- Tax Setup

- Business Setup

- Place Order

Not too scary, is it?

NAME + ADDRESS

The “Name and Address” section is where I entered the UPS address I purchased for the business, along with the phone number I acquired through Google Voice. That way, anything that is listed on public record will be completely associate with the business, nothing personal.

In this section they will also refer to something called a “registered agent”. Here’s LegalZoom’s explanation of a registered agent:

In most states you cannot use your UPS box as the address for the registered agent, but you can double check your state’s requirements here.

If you don’t want to list your home address as the address of the registered agent for safety reasons, LegalZoom offers a service where you can use them as a registered agent, which you can find here.

OWNERS AND MANAGEMENT

This section actually confused me a bit when I was signing up most for our LLC. I completely blanked on the terminology, and needed to do some research on the difference between an LLC that is member managed vs. manager managed.

After about ten minutes I found this really helpful FAQ page, so I thought I should save you a little time and give you the definitions for all this stuff up front. The question I was asking myself was:

What’s the difference between a “member” and a “manager” of an LLC?

The answer I found on the FAQ is the following:

A member is an owner of the LLC and is similar to a stockholder of a corporation. A manager is a person chosen by the members to manage the LLC and is similar to a director of a corporation. A manager can also be a member.

Makes sense, right?

Both Christopher and I are members of ShoHawk. If we wanted to hire someone to run our company, they would be considered a manager. But since they were not an owner of the company, they would not be considered a member.

When you get to this section, they will ask you if you want your LLC to run as “member managed”, or “manager managed.” Since it’s just Christopher and I right now, it really doesn’t matter, so we went with member managed.

However, hypothetically, if someone were to invest in ShoHawk as a silent partner, and had nothing to do with day to day operations, they could still sign contracts under a member managed LLC, since they are technically owners. That’s a little scary, and something we will definitely consider if we ever want to grow beyond the two of us.

If it were a manager managed LLC, only managers can make decisions, not owners.

The ownership rules of an LLC are very very flexible, which is a plus for an LLC. Corporations are fairly strict with distribution of stock, where an LLC is a little more loosey goosey. Since it’s just Christopher and I, we are splitting everything 50 /50.

If you are interested in involving more than one person in the business it’s good to know that you can split ownership by either 1) percentage, or 2) membership units. Membership units is similar to stock in a corporation. If you’re looking to go this route, I suggest digging into the details a little more.

TAX SETUP

The flexibility of the tax structure is one of the great upsides of an LLC. You can choose to be taxed as a:

• Sole proprietor

• Partnership

• C corporation

• S corporation

If only you own the LLC you can be taxed as a sole proprietor. If you have a partner, you can be taxed as a partnership. These are very easy tax returns and can be submitted with your personal return — you won’t need to file a separate tax return for the LLC.

If you choose to set up your LLC to be taxed as a C or S corporation you will go through double taxation, since the business will be treated as a separate entity.

BUSINESS SETUP

This section isn’t too difficult — you’re pretty much filling out what type of business you’ll conduct. “Video production” should be fine.

PLACE YOUR ORDER

You’re almost done!

Just enter your CC info and you’re good to go. LegalZoom will file your information with your state and create your “Articles of Organization”. Meaning, all the correct legal documents for an LLC.

How much is it? It depends on where you live, and what entity you’re setting up. The cheapest LLC package is $150, which isn’t too bad.

The more expensive packages come an LLC kit, and three months of Quickbooks Online. I would say skip the Quickbooks Online and get the Quickbooks software where you don’t pay a monthly fee, but that’s just my two cents.

SETTING UP AN EIN

An EIN? What does that mean? A EIN is an Employer Identification Number.

Your EIN is the number given to identify your business to the IRS. When the time comes to set up your business bank account, you’ll need the Articles of Organization (which you will receive from LegalZoom) and your EIN.

Setting up an EIN is super easy and straightforward. It’s also free. All you need to do is head over to the IRS website here, and complete the steps with your new business information.

You should receive your EIN immediately after you complete the steps.

You’ve now registered your business with your state and registered an EIN with the IRS!

You’re well on your way to getting your production company running.

THE TAKEAWAY

It can take a couple weeks to get your paperwork from LegalZoom, it really depends on how fast your state registers your papers. Once you have your paperwork back from LegalZoom and you EIN, you’ll be able to set up your small business checking account!

I’m going to save the business checking account for another post, but this should give you plenty to do.

If you have any thoughts on this process I would love to hear them below!

Great write up! Can you add something that deals with how you hire/bring on others onto whatever project you are doing? Meaning, do you use invoices/under the table deals/1099/etc. I’m in a similar place as you are in terms of where my production company is at, but not 100% on how to handle those elements from the financial/tax point of view.

The best article I’v ever seen about the same topic, very easy so clear!

Thank you MICHAEL + CHRISTOPHER

I’m glad that this article mentions how it’s possible to rent office space if you have money. This could be important to make sure you have room for your equipment and the space to film in order to get the best production. When choosing a facility for your studio, you’d probably want to figure out what options are available in your area so that you can choose something that you’ll be able to get to easily and will work for your project.

My sister wants to have a production at school for their alumni. It was explained here that having a production takes time and effort. Moreover, it’s advisable to go to professionals for transcripts for productions.

Definitely, hope this helped!

Cheers,

Michael

This is actually useful, thanks.

Glad it helped, Bobbie!